by debradzw | Mar 30, 2021

On Saturday, the finals of March Economic Madness, UT’s inter-scholastic team competition, were held. Four student teams from UT Austin and UT Permian Basin presented their proposals to address problems of small or remote communities, and one team was named this... Read More

by debradzw | Mar 10, 2021

On Saturday afternoon, UT Austin kicked off its first-ever interscholastic student team competition focused on issues facing small and remote communities. Dubbed “March Economic Madness,” the competition involves teams of students from both UT Austin and UT Permian... Read More

by Ridha Syed | Nov 10, 2020

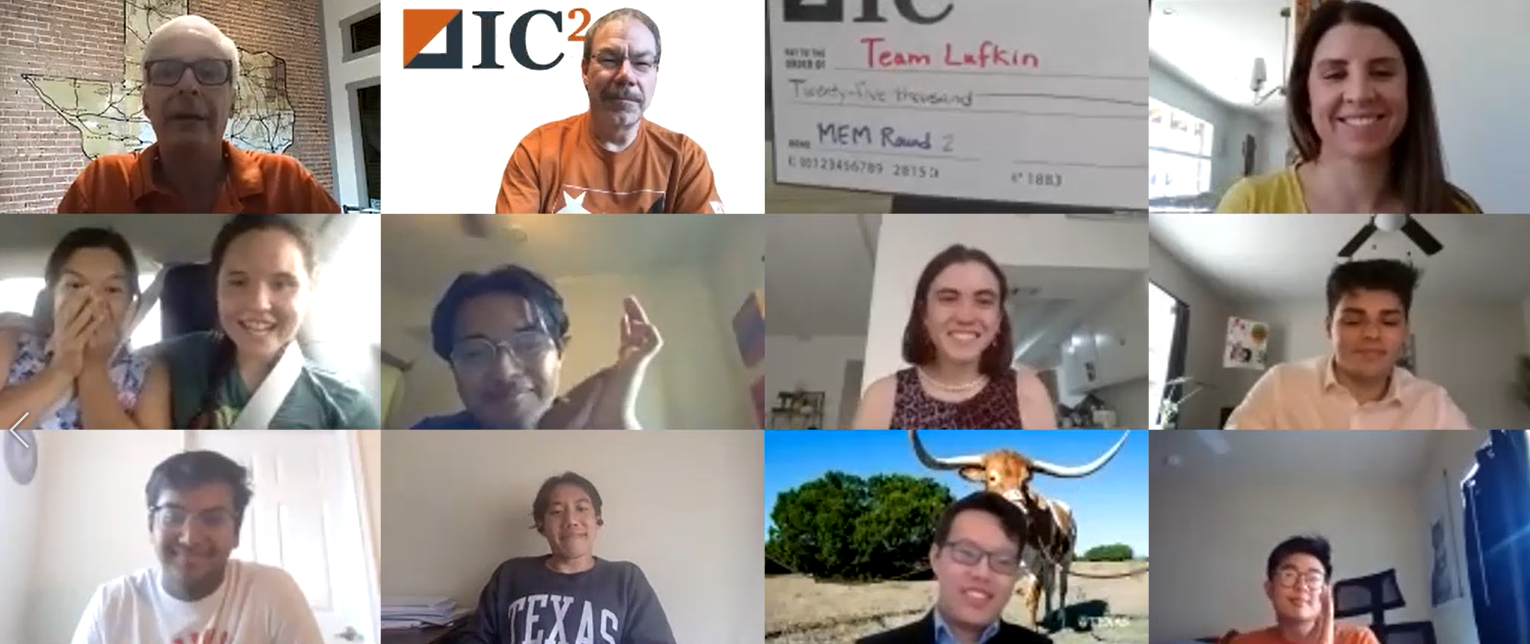

The long-awaited finals of the IC² Institute’s annual student challenge were held Saturday afternoon. The top ten student teams delivered live presentations before a panel of three expert judges, and at the end of the day three happy teams walked away with a total of... Read More

by Riffat Manasia | Nov 2, 2020

The Bureau of Business Research (BBR) at the IC² Institute is the lead institution on a newly awarded National Science Foundation collaborative research grant with Georgia State University. The grant funds the study of labor... Read More

by Ridha Syed | Oct 19, 2020

Oct 19, 2020: UT Austin’s Office of the Vice Provost for Diversity recently called for proposals for seed funding for faculty- or staff-led projects that promote increased diversity, equity, and inclusion (DEI) at the university. Actions that promote community... Read More

by Ridha Syed | Oct 12, 2020

Recognizing the need to address the plight of small businesses struggling to survive the current economic crisis, the IC² Institute applied to the Truist Charitable Fund for support. The Fund announced this summer that it would provide grants to organizations... Read More

by Ridha Syed | Oct 12, 2020

PANDEMIC PASS OR FAIL by: Alyssa Goard Posted: Oct 12, 2020 / 05:14 AM CDT / Updated: Oct 12, 2020 / 11:01 AM CDT Orange signs downtown in the city of Boerne alert visitors to open businesses, in hopes of encouraging people to buy local (KXAN... Read More

by debradzw | Oct 12, 2020

Tony Cantu, Patch • October 12, 2020 <Full news piece on Yahoo News> AUSTIN, TX — A newly released economic presents an overview of challenges across the state amid ongoing pandemic, and the findings are not good — with public sector job loss among the... Read More

by Caroline Jones | Oct 8, 2020

Harlingen student team that won the student challenge last semester. October 6, 2020: The IC² Institute has again launched the George Kozmetsky Memorial Student Challenge—a competition in which teams of UT Austin students research select Texas communities, receive a... Read More

by debradzw | Sep 17, 2020

UT Austin’s IC² Institute launched the Regional XLR8 program September 15th as part of its Regional Economic Recovery Initiative. The initiative grew as a response to the COVID-19 crisis and includes multiple components. Mapping the assets of over 60 communities,... Read More